RECENT NEWS

092523 United Way NELA Heirship Project 2023_Press Release email 090624

For 2023, we expanded the Heirship Project and conducted free CLE trainings for area lawyers in addition to continuing to provide free educational programing for Ouachita parish and surrounding areas.

The trainings were purposefully scheduled to occur a few weeks before the new NELA Bar Foundation’s monthly meeting to allow participants (both attorneys and community members) to learn and then prepare to work together to sort out heirship issues.

United Way NELA’s ‘The Heirship Project’ to host free events offering legal advice (knoe.com)

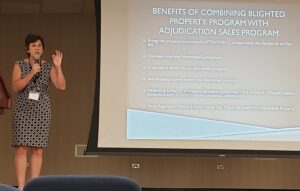

Attorney Wesley Johnson with E & P Consulting spoke with Jay Mitchell, Attorney for Ouachita Parish and Morehouse Parish Police Juries at the recent Police Jury Conference. Their focus was how to successfully use the adjudicated property program with a Fight the Blight Program.

Attorney Wesley Johnson with E & P Consulting spoke with Jay Mitchell, Attorney for Ouachita Parish and Morehouse Parish Police Juries at the recent Police Jury Conference. Their focus was how to successfully use the adjudicated property program with a Fight the Blight Program.

Heir property comes about when necessary legal work isn’t done after a property owner dies. Heirs who have a verbal agreement to live on the property, but no legal title could face many obstacles, including selling the property, making repairs on the property, or qualifying for government aid to fix damages to the home.

“After last year’s tornado, it became apparent to us that many of our residents are living in homes passed down from a family member. As a result, many of these residents do not have clear titles to their homes and properties,” said Michelle Saucer, Director of Community Initiatives at United Way NELA. “This gap in services needs to be addressed before another natural disaster or event affects these individuals.”

The Heirship Project will involve two workshops, one on Thursday, March 18th and another on Thursday, April 1st, both from 6:00-7:30pm. Interested individuals who reside in Ouachita Parish and need assistance obtaining a clear property title for heir property should contact 211 for registration details. Simply dial 211 from any landline or mobile phone (available 24/7), or text your zip code to 898-211 (available Monday-Friday, 8am-5pm).

“Our goal is to assist those residents who really need help clearing these property titles, but it’s also to educate the public,” said Kim Lowery, Director of Community & Organizational Strategy at United Way NELA. “We want to equip other local organizations so they can provide direction to their own clients.”

Wesley Eby Johnson with E & P Consulting, LLC and Escamilla & Poneck, LLP will provide education at both workshops. She says that families will have the opportunity to learn about various options, such as transferring property ownership to one or more individuals, selling the property to a third party, or continuing to have multiple heirs as owners of the property.

“Participants will be taught how to talk about these options with one another and how to be better stewards of the legacy properties left by their parents and grandparents,” said Johnson. “The end result of the Project should be that more property transfers will take place from the estates of the deceased to the heirs, leaving less properties becoming abandoned or blighted due to maintenance and repair needs not being met.”

For more information about The Heirship Project, dial 211 or text your zip code to 898-211.

###

La. R.S. 47:2202 specifically allows a political subdivision to sell adjudicated property without setting a minimum bid. However, the Louisiana Constitution prohibits a political subdivision from gratuitously loaning, pledging or donating public funds. La. Const. art VII, § 14(A) should not be ignored. The constitution is violated “when public funds or property are gratuitously alienated.”Board of Directors of the Industrial Development Board of the City of Gonzales, Louisiana, Inc. v. All Taxpayers, Property Owners, Citizens of the City of Gonzales, et al., 2005-2298 (La. 9/6/06), 938 So.2d 11, 20 (the “Cabela’s” case).Political subdivisions who sell adjudicated property without setting a minimum bid should document their Three Part constitutional rationale for accepting less than the statutory impositions, governmental liens, and costs of sale or less than 2/3 of the property's value for a particular property or a large grouping of properties. This type of documentation ensures that the political subdivision can defend any subsequent claims of unconstitutional donations. This is not a statutory requirement of the adjudicated sale process and is just a good idea to support solid and constitutional decision-making by the political subdivision.

Property that has been adjudicated for many years can end up with a redemption bill that far exceeds the worth of the property. Tax debtors must pay the full redemption costs and are prohibited from using the adjudicated property purchase process to reclaim property. La. R.S. 47:2209. However, if the tax debtor is not coming to reclaim the property then an exorbitant redemption bill can prevent the property from being returned to commerce thereby harming the political subdivision. The Louisiana Legislature enacted ACT 947 in 2010 that added language to La. R.S. 47:2202 to allow a political subdivision to sell property to the highest bidder at a public auction without setting a minimum bid or requiring an appraisal. This revision to the law should help political subdivisions get those less expensive properties back out into commerce. Political subdivisions that want to take advantages of this law should remember that the Louisiana Constitution still prohibits gratuitous donations. Therefore, a rationale that will support a no minimum bid sale should likely accompany such sales. Because each set of circumstances is different, the political subdivision should consult with its legal counsel to analyze whether decision-making on minimum bidding is constitutional and/or whether an Attorney General opinion is warranted.

We get this question a lot so have decided to answer it here. The tax debtor returns to redeem adjudicated property (or the grandchild of the tax debtor) and the property has been adjudicated for 15 years. Oftentimes the three-year constitutional right to redeem property (redemptive period) is mistaken for a deadline that, if passed, would prohibit the tax debtor from redeeming adjudicated property. Although the right to redeem has passed, there is no prohibition in the law that would prevent the political subdivision from allowing the redemption. La. R.S. 47:2246(A) authorizes the tax collector to allow the tax debtor to redeem the property after the initial 3 year period. La. 47:2245 authorizes him to issue the redemption certificate and provides him with the specific language to use. The person redeeming the property should pay the redemption costs and any additional notification costs in accordance with La. R.S. 47:2247. Where the confusion comes from:

Louisiana’s redemptive period is three years. The initial 3 years from the filing of the tax sale certificate by the tax collector when there was no third party purchaser is applicable redemptive period pursuant to the state constitution: Article VII, Section 25(B)(1) of the Louisiana Constitution; La. R.S. 47:2122 (11) The three year period runs from the date of recordation of the tax sale. During this time period, the tax debtor has an absolute right to reclaim “redeem” his property by paying the price given, including costs, five percent penalty thereon, and interest at the rate of one percent per month until redemption. This right to redeem exists regardless of whether the tax sale certificate is filed by a third party tax sale purchaser or the political subdivision. After that initial 3 year period (the applicable redemptive period), La. R.S. 47:2246(A) applies. La. R.S. 47:2246(A) states:

For property adjudicated to a political subdivision, after the expiration of the applicable redemptive period, any person may redeem tax sale title to property in the name of the tax debtor until any of the following shall occur:

- (1)The later of sixty days or six months, as applicable, after the notice required by RS 47:2206, or the filing of the sale or donation transferring the property from the political subdivision pursuant to RS 47:2201 et seq.

- (2)The granting of the order of possession pursuant to RS 47:2232

- (3)Sixty days or six months, as applicable, after the notice required by RS 47:2236.

(1)-(3) will take place if someone buys the adjudicated property or if the property was purchased at tax sale and the tax sale purchaser sends the 2206 notice.

So allow the redemption of adjudicated property that is otherwise just sitting on the tax rolls collecting dust, but you might want to remind the redeemer that the act of redeeming the property does not cause the property to be owned by that individual. If the individual redeeming the property is not the tax debtor, they should understand that the property will be redeemed in the name of the tax debtor. La. R.S. 47:2232 The parties (redeeming party and the tax debtor) can then work the matter out privately through a quitclaim deed, cash sale or, in many cases, probate. The redeeming party might also be a mortgagee who is redeeming the property to ensure that its interests are protected.

Political subdivisions need and want adjudicated property to get back into commerce so understanding that redemption is not a three year all or nothing concept for adjudicated properties is important!

The Louisiana Supreme Court heard oral argument in Central Properties v. Fairways, LLC on March 14, 2017.

The Court held that the appellate court erred in finding that the failure of the tax collector to provide post-sale written notice of the tax sale to the mortgagee required the tax sale to be set aside because post-sale notice to the interested tax party could be effectuated by a tax sale purchaser in accordance with La. RS 47:2156(A) and thus the requirement that the interested party must be duly notified of the tax sale under La. RS 47:2122(4) could be satisfied by the tax sale purchaser.